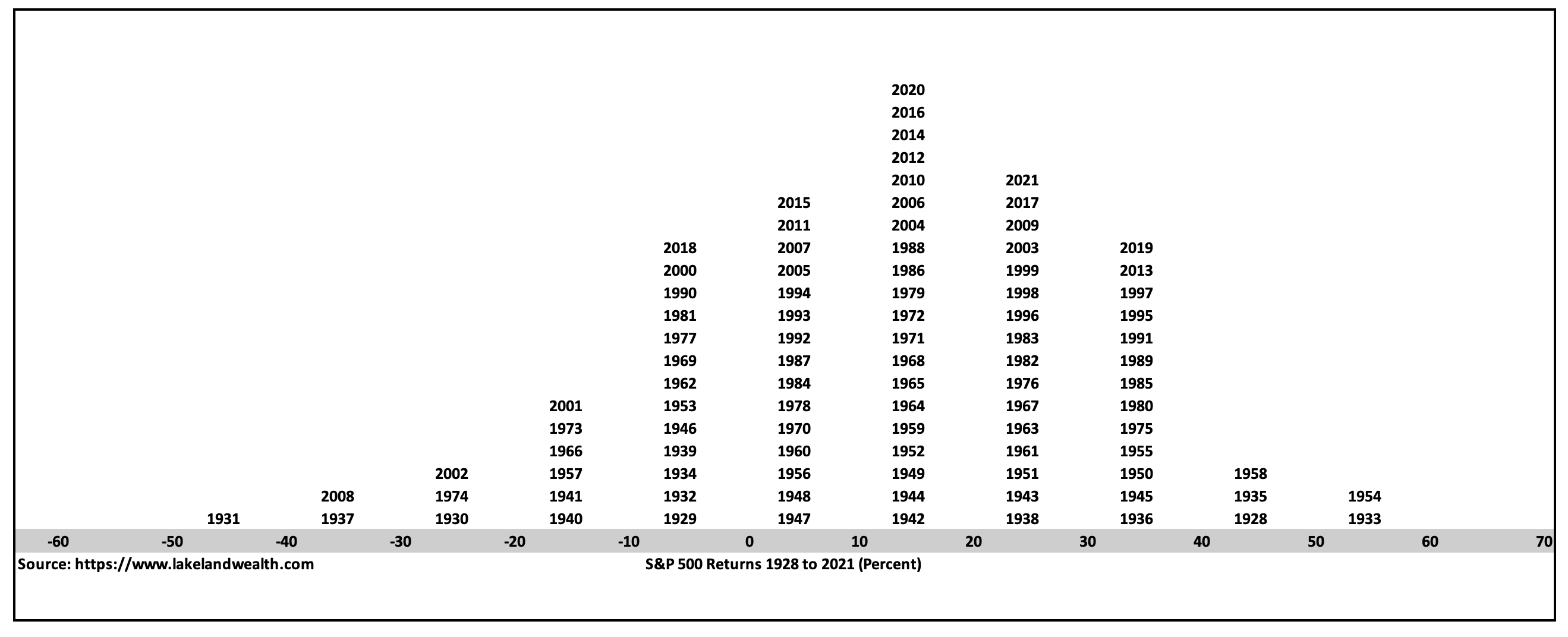

Historically market returns are positively skewed. I plotted the market returns from the pre-depression era to the last year, 2021. They ranged from negative 44 percent to 53 percent. If we ignore the outlier returns, in most years market returned between ten to twenty percent with an average return of twelve percent, including dividends. More than seventy-three percent of the time, market returns are positive, and some years market returns are negative. The key to investing is persistence and patience.

The recent 75 basis points hike in the interest rates and the Fed’s front-loading spooked the stock market a bit more because most of the market participants expected 50 basis points. Economic expectations are down-trending along with housing market sentiment, higher inflation, and the falling stock market.

After Fed spoke last week, the market is pre-pricing 2.75 to 3% Fed rate at the end of 2022 and 3.75% or more by the end of 2023. So the tantrum is all about additional 25 basis points by the Fed.

Fear is at its peak. Exogenous Oil shocks, the war in Europe, supply constraints, and tightening monetary policy are already discounted in the market prices. There is no guarantee that the market trend will reverse immediately, but the bleeding should soon abate.