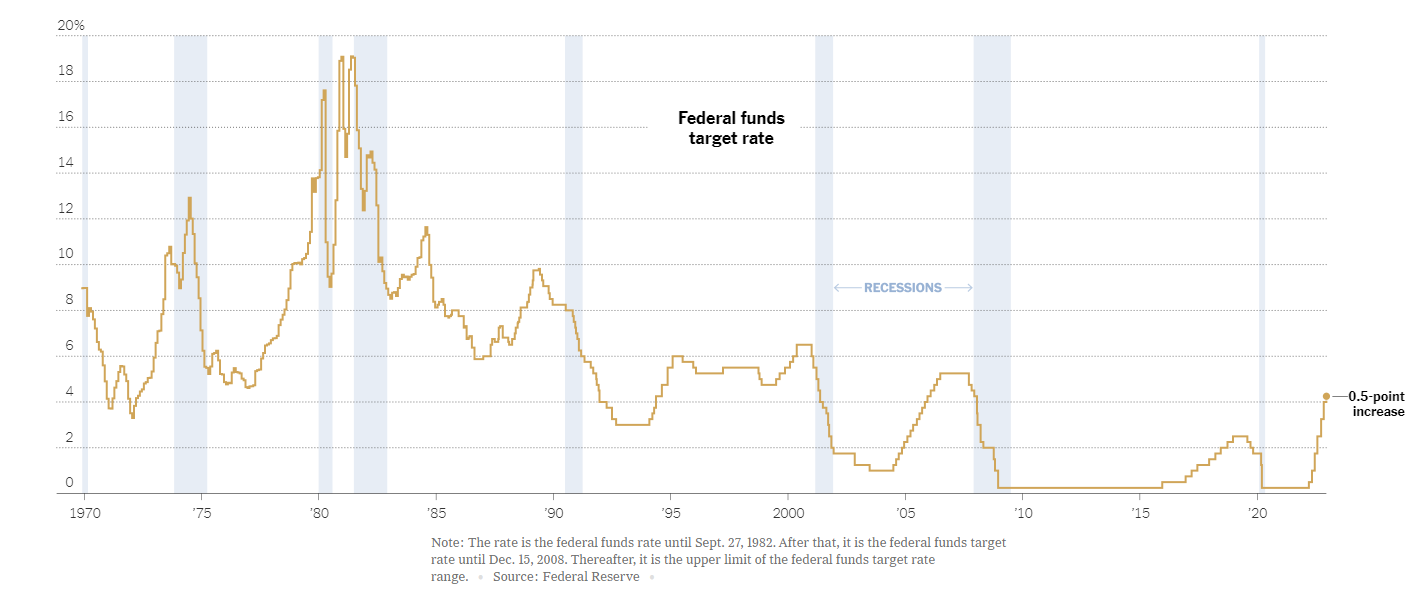

Federal Reserve raised the interest rate by 50 basis points to 4-1/4 to 4-1/2 percent given the stubbornly high Inflation, lower unemployment, and broad price pressure due to supply imbalance between aggregate demand and supply.

Recent employment and inflation data have zigged and zagged in many directions this year. In some months, data came in worse than expected. Others brought a fleeting burst of good news.

In the recent nonfarm payroll employment report, employers added 263,00 in November, and the unemployment rate was 3.7%. Over the past 12 months, all items’ CPI increased by 7.1%, slightly less than the market expected but staying at a historically high rate.

The shelter index was the dominant factor in the monthly increase in the index for all items, less food, and energy; The shelter index continued to increase, rising 0.6 percent over the month. The rent index rose 0.8 percent over the month, and the owners’ equivalent rent index rose 0.7 percent. The index for lodging away from home decreased by 0.7 percent in November after increasing by 4.9 percent in October. Higher mortgage rates have yet to dampen the higher housing prices.

Part of the higher wages was low labor participation, great resignation during COVID season and 1.5 million excess deaths during the COVID period, and more than a million short supply of legal immigration during the past two years.

If we look at history, Inflation is downward sticky, just like workers’ wages. In March 1980, Inflation peaked at 14.6%, and Fed raised rates to 19.1% to bring Inflation back to the neutral rate in June 1981. Fed kept interest rates 500 basis points above the Inflation for a decade until June 1990. Given the strong employment conditions and stubbornly high Inflation, Fed will continue the rate raises in the next year. Don’t expect the so-called Fed Pivot anytime soon.