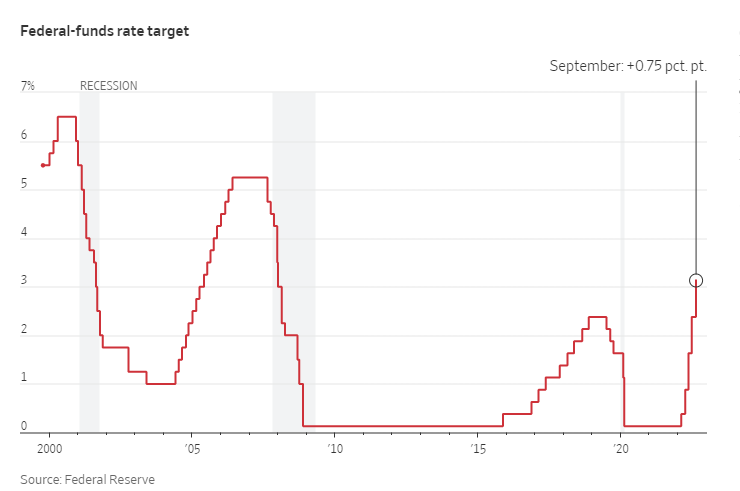

Officials project short-term rates will rise above 4.25% by year’s end, signaling further large increases at future meetings.

The Federal Reserve approved its third consecutive interest-rate rise of 0.75 percentage points. It signaled significant additional increases were likely at future meetings as it combats inflation that remains near a 40-year high.

The decision Wednesday, unanimously supported by the Fed’s 12-member rate-setting committee—will lift its benchmark federal-funds rate to a range between 3% and 3.25%, a level last seen in early 2008.

Federal Reserve stated robust job growth, historical unemployment levels, supply-demand imbalances, and global economic strains due to the border war between Russia and Ukraine are some of the factors for the persistent inflation.

Pingback: buying cialis generic

Pingback: where to order viagra online

Pingback: viagra online no prescription canada

Pingback: genuine viagra australia

Pingback: viagra 100mg tablet online

Pingback: generic viagra cost in canada

Pingback: cialis canada pharmacy no prescription required

Pingback: cheap canadian cialis

Pingback: where to buy cialis cheap

Pingback: cialis for performance anxiety

Pingback: metronidazole antabuse

Pingback: bactrim sulfamethoxazole trimethoprim

Pingback: neurontin nuspojave

Pingback: valtrex medline

Pingback: pregabalin tremor side effects

Pingback: tamoxifen her2

Pingback: lisinopril cinfa

Pingback: furosemide nierfalen

Pingback: metformin blutdruck

Pingback: does semaglutide need to be refrigerated

Pingback: semaglutide 4 months

Pingback: semaglutide other names

Pingback: cephalexin dog uti

Pingback: zoloft morning or night

Pingback: metronidazole 5mg/ml

Pingback: brand for escitalopram

Pingback: how long does it take fluoxetine to leave your system

Pingback: whats lexapro used for

Pingback: gabapentin 250/5ml

Pingback: does keflex treat kidney infection

Pingback: will diarrhea from cymbalta go away

Pingback: buy cheap viagra in usa

Pingback: duloxetine brain zaps

Pingback: amoxicillin yeast infection

Pingback: can i drink alcohol with ciprofloxacin 500 mg

Pingback: is cephalexin safe during pregnancy

Pingback: bactrim for bv

Pingback: allergic reaction to bactrim after 7 days

Pingback: depakote uses

Pingback: cozaar uses

Pingback: ferring ddavp nasal spray

Pingback: what is diltiazem used for

Pingback: flexeril addiction

Pingback: simultaneous estimation of ezetimibe and simvastatin

Pingback: diclofenac sodium 75mg

Pingback: alcohol and augmentin

Pingback: mounjaro and contrave together

Pingback: flomax dental treatment

Pingback: coming off effexor weight loss

Pingback: what are the side effects of citalopram

Pingback: azathioprine and allopurinol

Pingback: aspirin heart attack

Pingback: aripiprazole reviews

Pingback: what are the bad side effects of amitriptyline

Pingback: augmentin generics

Pingback: how long for bupropion to work

Pingback: ashwagandha withdrawal

Pingback: celecoxib dose

Pingback: wellbutrin with celexa

Pingback: does buspar make you gain weight

Pingback: semaglutide weight loss

Pingback: does robaxin make you drowsy

Pingback: actos adverse

Pingback: acarbose food

Pingback: side effects protonix

Pingback: repaglinide renal

Pingback: risperidone vs abilify

Pingback: how does remeron work in the brain

Pingback: is there a generic to voltaren

Pingback: tizanidine 4mg cost

Pingback: empagliflozin sitagliptin combination

Pingback: spironolactone 100 mg for acne

Pingback: tamsulosin cancer

Pingback: ivermectin purchase

Pingback: synthroid fasciculations

Pingback: anxiety medication venlafaxine

Pingback: cialis online pills

Pingback: maximum dose of sildenafil in 24 hours

Pingback: how to make levitra more effective

Pingback: where to buy levitra

Pingback: mtf hormones online pharmacy

Pingback: cialis daily tadalafil (generic)

Pingback: sildenafil citrate 100mg

Pingback: online pharmacy lortab no prescription

Pingback: vardenafil dosing

Pingback: stromectol 3 mg tablet

Pingback: viagra over the counter united states

Pingback: ivermectin medication

Pingback: ivermectin 12 mg

Pingback: ivermectin otc

Pingback: vardenafil (levitra)

Pingback: generic ivermectin for humans

Pingback: cheap tadalafil 40 mg

Pingback: buy ivermectin for humans australia

Pingback: tadalafil and dapoxetine in india

Pingback: sildenafil 100mg sale

Pingback: people who take provigil

Pingback: is doxycycline safe in pregnancy

Pingback: cephalexin strep throat

Pingback: ciprofloxacin alcohol

Pingback: valtrex prescription

Pingback: does amoxicillin cause yeast infection

Pingback: ampicillin neonate dosing

Pingback: lisinopril and diabetes

Pingback: can you overdose on trazodone

Pingback: glucophage bula

Pingback: is pregabalin an opioid

Pingback: keflex ear infection

Pingback: tamoxifen nursing interventions