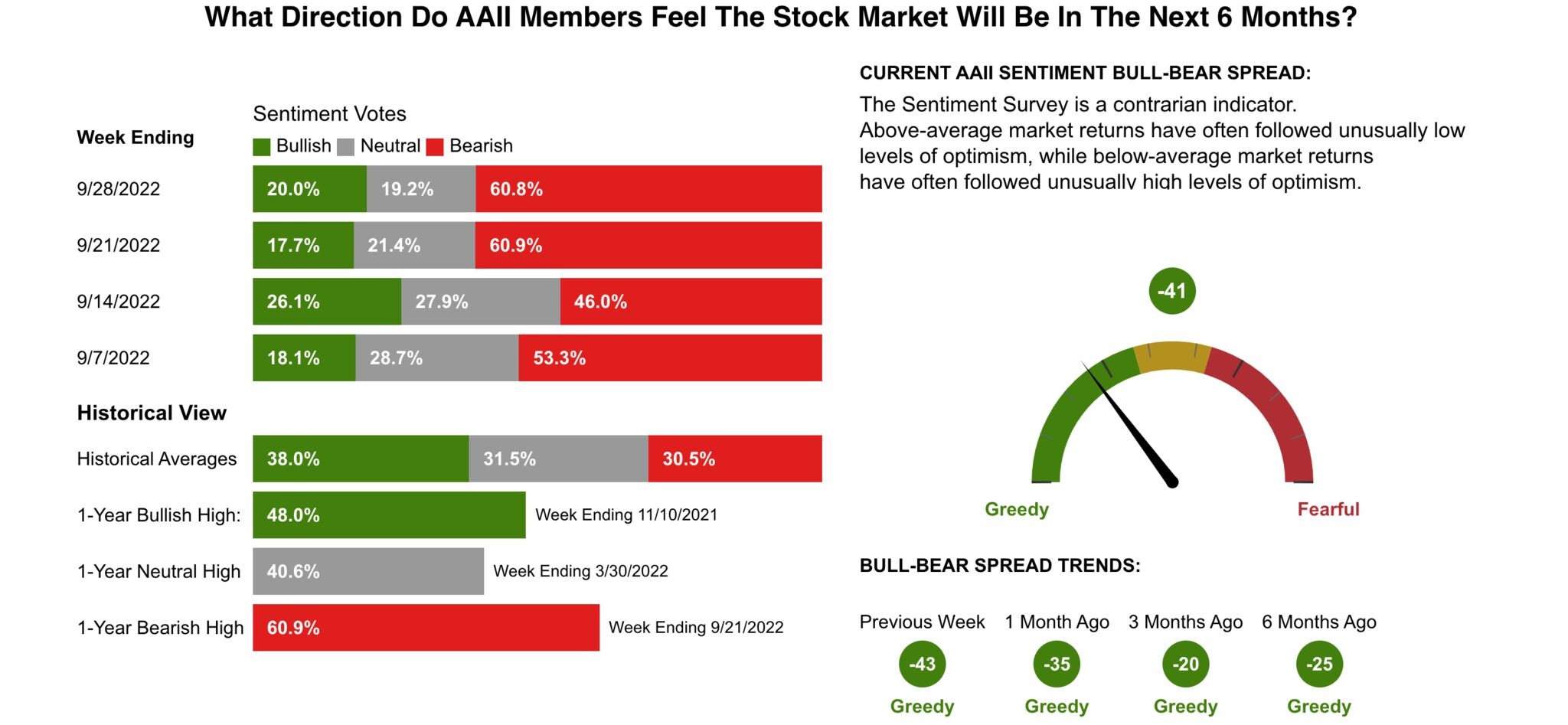

AAII sentiment indicator shows pessimism at 60%. Sentiment describes a group of people’s opinions, emotions, or views. In investing, sentiment can be a powerful determinant of security prices, especially in the short run. Emotions—whether rational or irrational—can drive market prices. The price at which an individual security trades is the total sentiment of all market participants.

Legendary Investor Warren Buffett once said, “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

Just like a bargain on socks may be an opportunity for buyers, a bargain on stocks is an opportunity for potential upside. The S&P 500 Index has seen double-digit gains 85% of the time after extremely pessimistic sentiment since 1987.

For example, the bull-bear spread in October 1990 was -54%, and S&P 500 returned 26% in the next 12 months; in August 1990, the spread was -38% S&P 500 returned 23% in the next 12 months.

Bad times don’t last forever; despite the market sentiment, it is wise to keep investing in great companies under proven leadership. Once the market is confident that inflation clouds are clearing, markets will rebound with vengence. Investors who stay calm during rough times get pleasantly rewarded.