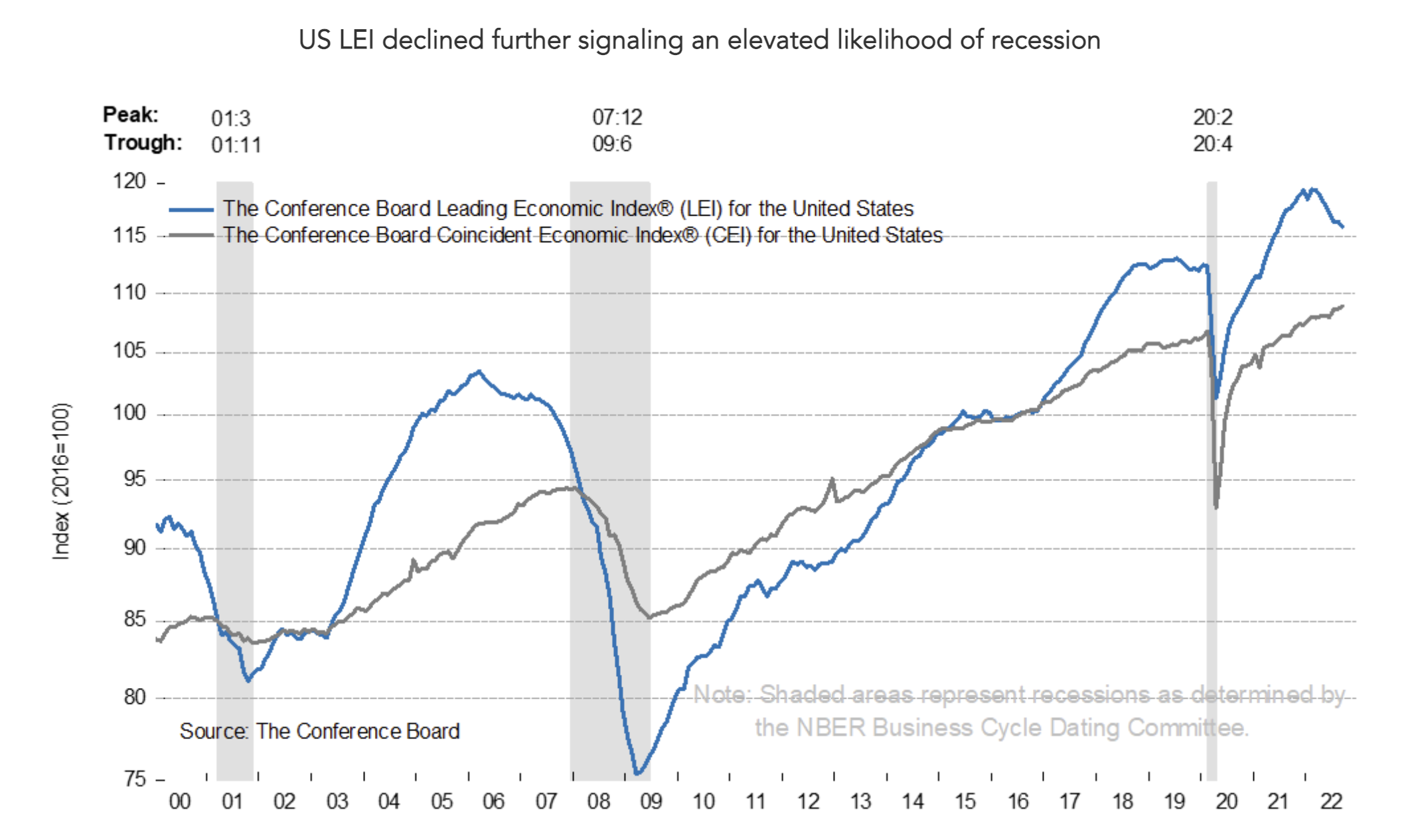

The spread between 10-year and three-month bonds is in negative territory, implying financial institutions have less incentive to extend loans to borrowers. The latest data from the conference board suggests the leading economic indicators are dropping.

We hear the big “R” word (recession) often by the corporate leaders in the quarterly meetings. Global firms are tightening their belts by cutting operating expenses and Capex.

The six-month growth rate of the LEI fell deeper into negative territory in September, and weaknesses among the leading indicators were widespread.

Amid high inflation, slowing labor markets, rising interest rates, and tighter credit conditions, The Conference Board forecasts real GDP growth will be less than the projected 1.5 percent in 2022 before a recession in the first half of next year.