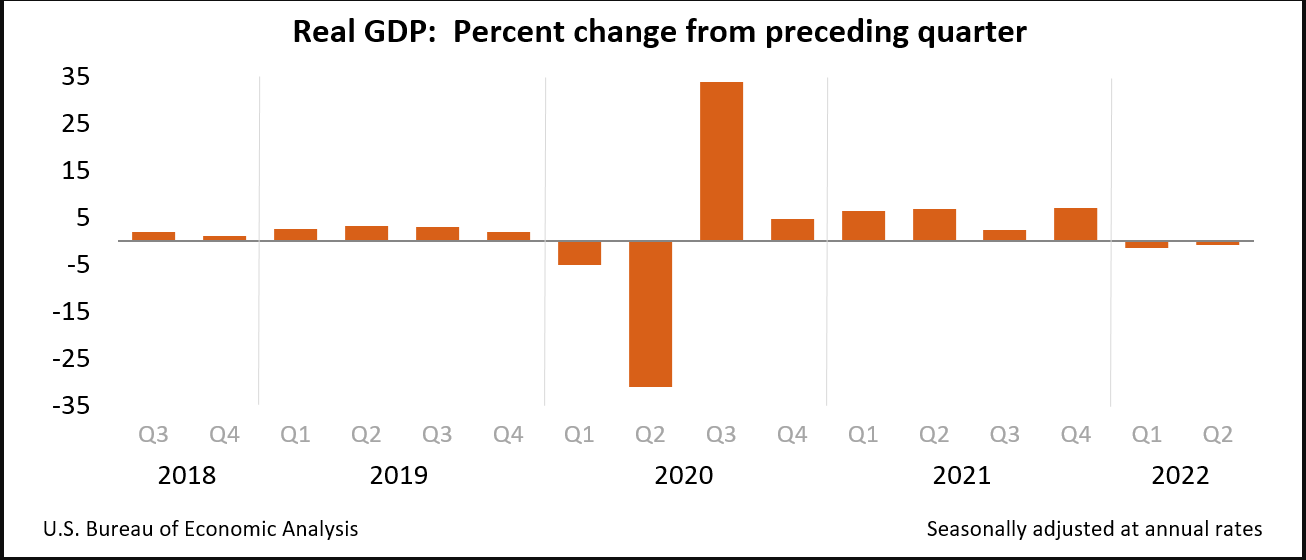

The US economy shrunk by annualized 0.9% after contracted in the first quarter of 2022. Historically recessions are measured by falling real GDP in two consecutive quarters. However National Bureau of Economic Research defines a recession as a significant decline in economic activity spread across the economy for more than a few months. It’s Business Cycle Dating Committee considers factors including employment, output, retail sales, and household income—and it usually doesn’t make a recession determination until long after the fact.

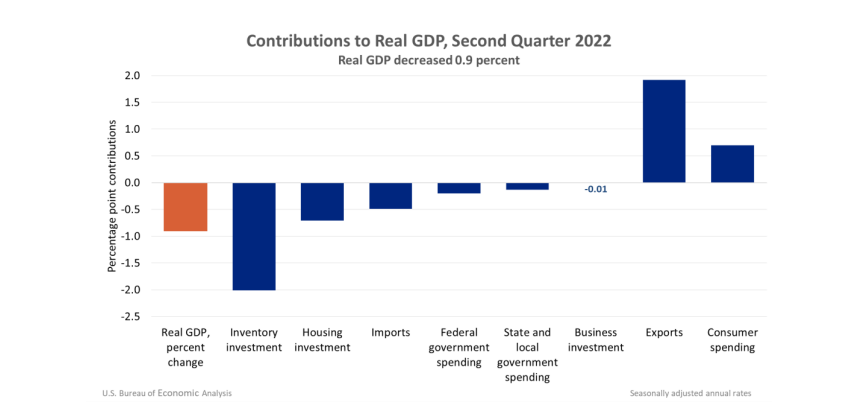

- The second quarter decrease in real GDP reflected declines in inventory investment (reduction of general merchandise and vehicles), housing investment (drop in broker’s commissions), federal government spending, state and local government spending, and business investment.

- Exports and consumer spending increased. Imports, which are a subtraction in the calculation of GDP, increased.

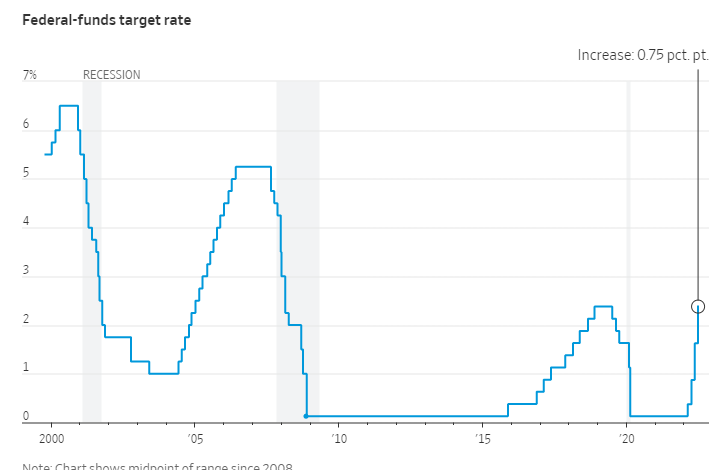

Other significant factors influencing the economy are the robust employment levels, where unemployment stayed at a historically lower rate of 3.6%, and consumer spending is strong. That stands in contrast to the slowing pace of economic output and inflation trending at a four-decade high prompted Fed to raise the federal fund rate to a range between 2.25% to 2.5%.